How to Trade Breakouts Using Trend Lines|Trading with trend lines forex course: The Trend Breaker Forex Trading Strategy

1. MACD - The inputs for this indicator are: Fast Length= 12 (represents the previous 12 bars of

the faster moving average), Slow Length= 26 (Represents the previous 26 bars of the slower

moving average), and Signal Smoothing= 9 ( represents the previous 9 bars of the difference

between the two moving averages. This is plotted by vertical lines called a histogram).

2. Simple Moving Averag e- The inputs for this indicator are: Length 8, Offset 0. (Red line )

3. Exponential Moving Average -The inputs for this indicator are: Length 20, Offset 0. ( Blue line )

This strategy also uses three different time frames. They are the 4 hour , the 1 hour , and 15 minute

time frames. This top down approach uses these time frames to identify a trend, find a break out

point, determine an entry point, and execute the trade.

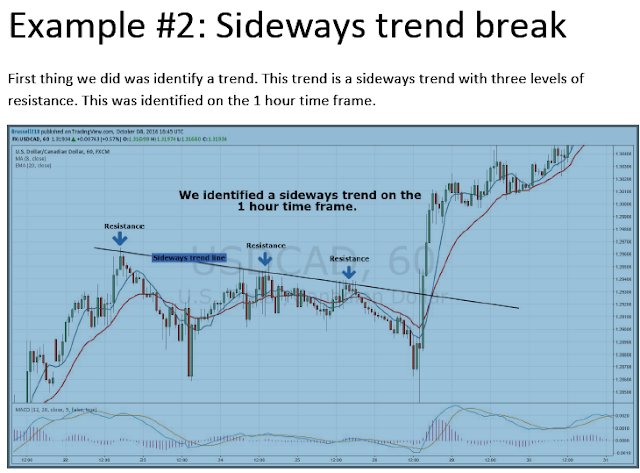

Step One: Identify a trend

First thing you need to do is identify an upward, downward, or sideways trend by switching to a

4-hour and 1 hour time frames. The reason both are used is that it will give you the best perspective

in determining a trend according to this strategy. Draw a trend-line so that 3 points of resistance or

support was touched.

Since this strategy focuses on trends, a trend line will be drawn on the support or resistance lines of

the trend. The criteria for a trend is that there needs to be at least three points of resistance or

support.

As you can see on on the 4- hour time frame below this clearly is a downtrend.

As you can see in the chart above on the 15 minute time frame, the MACD lines were crossed. When

the crossover of the fast length and slow length occurs, this will signal a new trend.This gave an

indication that a trend was breaking. The moving average, and exponential moving average lines also

crossed. So when the MACD lines cross and the simple moving average/ exponential lines cross wait

until the candlesticks go above/below trend line that was drawn in step one, then identify a point of

entry into the trade.

So looking at our example above the criteria was met to go to step three because the SMA and EMA

crossed and the MACD lines crossed. Also the trend went upwards and hit our trend line. This is a

signal to go to step three.

If neither of the indicators cross before the candlesticks close and hit the trend line then do not go

any further because the trade does not meet the criteria of the rules. The indicators need to show

that the trend broke before it touched the trend line.

Note* When our indicators are crossing, the trend needs to be heading toward the trend line that was

drawn in step one. This is because the trend is breaking and a breakout is about to occur. When the

breakout happens we will discuss when to make an entry.

Step Three: Identify a point of entry

Here is a list of the entry criteria:

These 4 things must happen to enter a trade.

1. Simple Moving Average Must Cross below the Exponential moving average.

2. MACD must cross

3. The price must break below or above trend line.

4. After the break of the trendline you must wait for 3 candles to close on the 15 minute chart

before taking your entry.

Now we need to identify a point of entry. To identify a point of entry always use the 15 minute time

frame in this strategy.

So in our example below, we see that there is an obvious stand-off between buyers and sellers on the

trend line.

Once there is at least three candle sticks above or below the trend line, you execute the trade.

In this example there are three candlesticks that fell above the trend line after our indicators signaled

that the trend was broken. At this point you want to make an entry. Again, this must always be done

on a 15 minute time frame to show us that three 15 minute candlesticks closed above or below the

trend line that you drew.

You can clearly see that there are two levels of support in the above example. Use the support levels

to determine the stop loss. The rules were to place the stop loss below the last support level which is

why you see the stop loss below these levels.

Step five: Exit Rules

The plan clearly identified a trend, a breakout point, point of entry, and determined a stop loss. The

final step is to determine the exit point of your trade. This strategy uses 1 risk to 3 reward ratio.

What that mean is you have the potential to make 3 times more than you are risking.

To do this you, the first thing that needs to be done is identifying how many pips there are from your

entry point to your stop loss. So let’s just say you had 24 pips in between these positions. Since we are

using a 1 risk to 3 reward ratio, we would simply multiply the number of pips in between the stop and

entry by 3. This would give us 72.

So 72 pips would be the target number for that trade.

As you can see in the example below, the target was hit with a gain of +72 pips!

The rules were followed, the ratio of a risk of 1 to 3 reward was put in place, and the trading strategy

worked to perfection!

This Trend Breaker Strategy is simple and yet effective. There is no need to stress and worry that you

made the wrong trade. You follow the rules and do not let anything else make you back out of a trade.

If it follows the rules, execute the trade with confidence.

Always remember to only be risking no more than 2% of your account!

This will help you identify daily trends and points where they break. There is no need to force yourself

into a trade. If it does not follow your rules and guidelines then search for another pair to trade.

If for any reason you had any questions, or suggestions about this strategy you can always reach us at